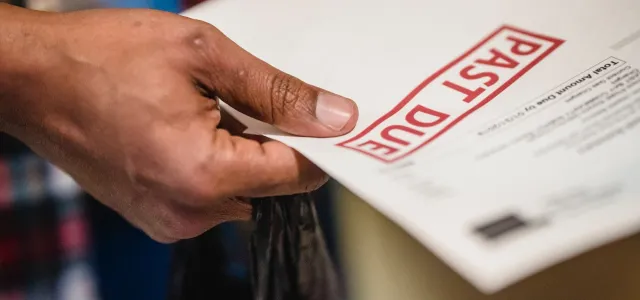

Are you making one of these common financial mistakes? Here are some steps to consider.

Read More

Spending your retirement years in a new country can be exciting, so long as you're prepared.

Read More

If you’re struggling to save for retirement because of debt, it’s never too late to start.

Read More

If you’re looking to lower your tax liability before the deadline, here are some options to consider.

Read More

If you’re in your 50s and haven’t done much to save for retirement, you still have time.

Read More

A clear understanding of what wealth looks like to you may help you build a financial strategy.

Read More

Feel overwhelmed by tax documents? Staying organized may help reduce your tax season stress.

Read More

Many of us have experienced the cost of financial literacy gaps at one point or another. And if you’re like most folks, the gaps in your financial literacy

You can’t control everything when you travel. But you can control what you know, how you get ready to get away, and what you do while you’re vacationing.

And

Read More

Are you currently negotiating a new job offer or searching for a new role?

This article aims to guide you on your journey.

The question is: how do you ensure

Read More

Would you enjoy your retirement more in the U.S. or abroad?

Read More

In a shocking turn of events, the Supreme Court has halted the presidential student loan forgiveness plan.1 So, where does that leave you and your outstanding

Read More